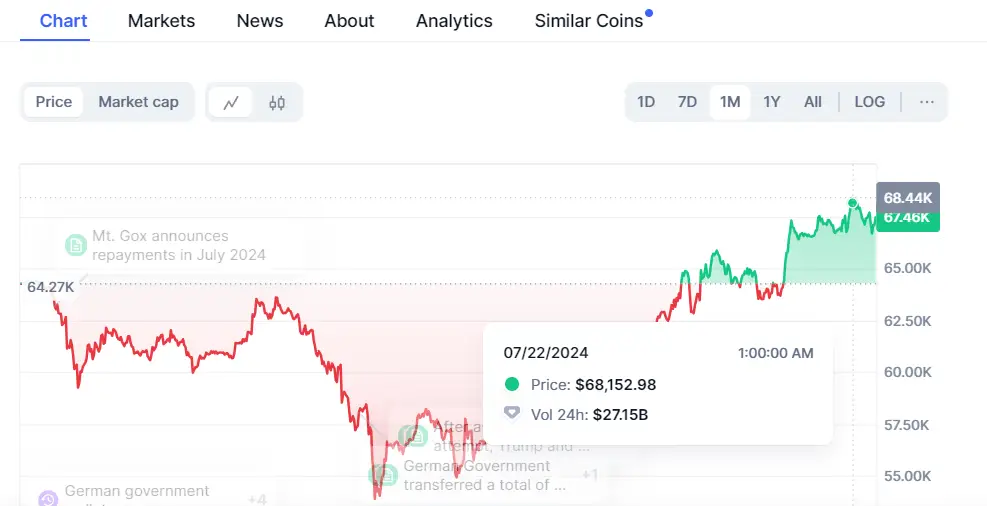

Bitcoin Surges Past $68,000: Key Drivers and Future Implications

Bitcoin, the leading cryptocurrency by market capitalization, has experienced a dramatic surge, surpassing the $68,000 mark for the first time in its history. This landmark achievement has garnered significant attention from investors, analysts, and the broader financial community. This article delves into the key factors driving this historic rally, explores the implications for the future of Bitcoin and the broader cryptocurrency market, and provides insights into potential challenges and opportunities ahead.

Factors Driving the Rally

- Anticipation of Ethereum ETFs: One of the primary drivers behind Bitcoin’s recent surge is the growing anticipation surrounding the launch of Ethereum Exchange-Traded Funds (ETFs). These ETFs are expected to provide institutional investors with a more accessible and regulated way to invest in Ethereum, which could, in turn, drive increased interest and investment in the broader cryptocurrency market, including Bitcoin. The approval of Bitcoin ETFs in the past has shown how such financial products can act as a catalyst for price increases.

- President Biden’s Reelection Campaign: Political developments can significantly influence financial markets, and cryptocurrencies are no exception. President Joe Biden’s reelection campaign has injected a sense of stability and continuity into the U.S. political landscape, which is generally seen as favorable for the markets. Investors often seek stability, and a predictable political environment can encourage investment in riskier assets like cryptocurrencies.

- Institutional Adoption: Over the past few years, institutional adoption of Bitcoin has steadily increased. Major companies, including Tesla, Square, and MicroStrategy, have added Bitcoin to their balance sheets. Additionally, financial giants like Fidelity and BlackRock have begun offering Bitcoin-related investment products to their clients. This institutional interest not only validates Bitcoin as a legitimate asset class but also increases demand, driving up prices.

- Macro-Economic Factors: The broader macroeconomic environment has also played a crucial role in Bitcoin’s recent rally. Concerns over inflation, driven by expansive monetary policies and stimulus measures in response to the COVID-19 pandemic, have led investors to seek alternative stores of value. Bitcoin, often referred to as “digital gold,” is increasingly being viewed as a hedge against inflation and currency devaluation.

- Technological Developments: Advances in blockchain technology and the Bitcoin network itself have contributed to the growing confidence in the cryptocurrency. The implementation of the Taproot upgrade, which enhances Bitcoin’s privacy and scalability features, is one example of how ongoing technological improvements can bolster investor sentiment.

Implications for the Future

- Increased Mainstream Adoption: Bitcoin’s surge past $68,000 is likely to drive further mainstream adoption. As the cryptocurrency reaches new highs, it garners more media attention, which can attract new retail and institutional investors. Increased adoption can create a positive feedback loop, driving prices even higher.

- Regulatory Scrutiny: With greater adoption and higher prices come increased regulatory scrutiny. Governments and regulatory bodies around the world are paying closer attention to cryptocurrencies. While some regulation is necessary to protect investors and ensure market stability, overly stringent regulations could stifle innovation and hinder growth. The balance between regulation and innovation will be a critical factor in Bitcoin’s future trajectory.

- Market Volatility: Despite its recent gains, Bitcoin remains a highly volatile asset. Investors should be prepared for significant price fluctuations. While the long-term outlook may be positive, short-term corrections and market volatility are to be expected. Risk management and a long-term investment perspective are essential for navigating the cryptocurrency market.

- Impact on Altcoins: Bitcoin’s performance often influences the broader cryptocurrency market. As Bitcoin rallies, it can lead to increased interest and investment in other cryptocurrencies, known as altcoins. Ethereum, in particular, stands to benefit from the anticipation of ETFs and increased institutional interest. However, investors should conduct thorough research and consider the unique value propositions of each cryptocurrency.

- Technological and Network Improvements: Ongoing technological advancements and network improvements will continue to play a vital role in Bitcoin’s evolution. Upgrades like Taproot enhance the functionality and security of the Bitcoin network, making it more attractive to users and investors. Additionally, developments in second-layer solutions, such as the Lightning Network, aim to address scalability issues and improve transaction speeds, further bolstering Bitcoin’s utility.

Potential Challenges

- Regulatory Uncertainty: While regulation can provide legitimacy and stability, uncertainty around regulatory frameworks poses a significant challenge. Differing approaches to cryptocurrency regulation across countries can create a fragmented market, complicating compliance for global investors and businesses.

- Security Concerns: Despite advances in security, the cryptocurrency market remains vulnerable to hacks and scams. High-profile security breaches can undermine investor confidence and negatively impact market sentiment. Continuous efforts to enhance security protocols and educate investors about best practices are essential.

- Market Manipulation: The relatively low liquidity of the cryptocurrency market compared to traditional financial markets makes it susceptible to manipulation. Whales (large holders of cryptocurrency) can significantly influence prices through large buy or sell orders. Transparency and measures to prevent market manipulation are crucial for maintaining market integrity.

- Environmental Impact: Bitcoin mining is energy-intensive, raising concerns about its environmental impact. The industry is exploring more sustainable practices, such as using renewable energy sources for mining operations. Addressing environmental concerns is critical for the long-term viability of Bitcoin and its acceptance by environmentally-conscious investors.

Market Opportunities: Investors looking to capitalize on Bitcoin’s growth can explore platforms like PrimeXBT, which offers innovative trading tools and strategies for both new and experienced traders.

- Bitcoin’s surge past $68,000 marks a significant milestone in the cryptocurrency’s history. Driven by factors such as the anticipation of Ethereum ETFs, political stability, increased institutional adoption, macroeconomic conditions, and technological advancements, Bitcoin has captured the attention of the financial world. While the future holds promising opportunities for further adoption and growth, challenges such as regulatory uncertainty, security concerns, market manipulation, and environmental impact must be navigated carefully. As Bitcoin continues to evolve, it remains a compelling and dynamic asset in the ever-changing landscape of finance and technology. Investors and stakeholders must stay informed and adaptable to harness the potential of this groundbreaking digital asset.